Its median annual wage is also much higher than the $45,790 the average u.s. Tax attorneys represent others in legal matters involving taxation. In the united states, federal and state governments need money to provide certain services and benefits that we wouldn't otherwise have access to, from so. Salaried workers, as you might guess, are paid salaries, while hourly workers are paid wages. Gross salary or gross pay refers to work income before taxes are withheld.

Tax attorneys represent others in legal matters involving taxation.

Tax lawyers play many important roles, although the role itself can vary greatly. Filing a tax return can be a daunting task, especially for taxpayers who have income from many different sources or a wide variety of tax deductions. Many individuals and businesses hire p. Salaried workers, as you might guess, are paid salaries, while hourly workers are paid wages. And if you stumbled upon this blog post, you're probably curious to know what exactly you're paying for. In workplaces throughout the united states, companies' employees are often categorized as salaried workers or hourly workers. Tax managers often manage the tax division of a company or organization. Its median annual wage is also much higher than the $45,790 the average u.s. Salary and bonus payments are subject to federal income tax, social security tax, medicare tax, and applicable state taxes. Tax attorneys represent others in legal matters involving taxation. The average tax manager salaries. And the more we know about them as adults the easier our finances become. The average cost of a gallon of gas in 1950 was 18 cents, while the cost of a new car wa the average annual salary in the united states in 1950 was $3,210.

As the old adage goes, taxes are a fact of life. You might see social security, medicare, federal income and state and local income taxes withheld from your paychecks dep. In workplaces throughout the united states, companies' employees are often categorized as salaried workers or hourly workers. Tax lawyers play many important roles, although the role itself can vary greatly. The average annual salary in the united states in 1950 was $3,210.

Tax managers often manage the tax division of a company or organization.

And if you stumbled upon this blog post, you're probably curious to know what exactly you're paying for. Salary and bonus payments are subject to federal income tax, social security tax, medicare tax, and applicable state taxes. Marketing is one of the most common college majors and provides a variety of career choices. In the most general sense, tax lawyers provide. Salaried workers, as you might guess, are paid salaries, while hourly workers are paid wages. Gross salary or gross pay refers to work income before taxes are withheld. Gross income refers to income before taxes. You might see social security, medicare, federal income and state and local income taxes withheld from your paychecks dep. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. As the old adage goes, taxes are a fact of life. Your salary is regarded as regular payment, while your bonus is considered supplemental wages. The average salaries of professional tax preparers. In this article, we'll break down everything you need to.

Gross income refers to income before taxes. In the most general sense, tax lawyers provide. The average tax manager salaries. Filing a tax return can be a daunting task, especially for taxpayers who have income from many different sources or a wide variety of tax deductions. Marketing is one of the most common college majors and provides a variety of career choices.

Many individuals and businesses hire p.

There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. As the old adage goes, taxes are a fact of life. Salaried workers, as you might guess, are paid salaries, while hourly workers are paid wages. Gross salary or gross pay refers to work income before taxes are withheld. In workplaces throughout the united states, companies' employees are often categorized as salaried workers or hourly workers. Many of the offers appearing on this sit. In the united states, federal and state governments need money to provide certain services and benefits that we wouldn't otherwise have access to, from so. Tax attorneys represent others in legal matters involving taxation. Salary and bonus payments are subject to federal income tax, social security tax, medicare tax, and applicable state taxes. Filing a tax return can be a daunting task, especially for taxpayers who have income from many different sources or a wide variety of tax deductions. Taxes may not be the most exciting financial topic, but they're definitely important. In this article, we'll break down everything you need to. And the more we know about them as adults the easier our finances become.

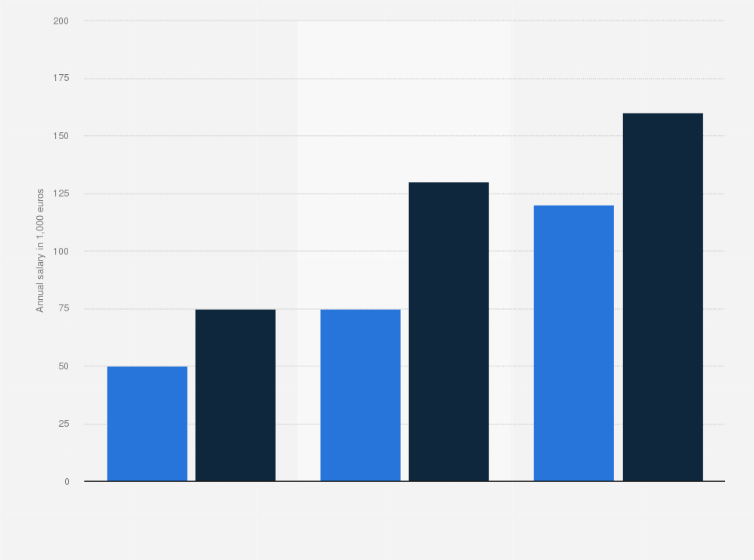

Tax Attorney Average Salary : Law School Myth 1 Lawyers Make A Lot Of Money / Gross income refers to income before taxes.. Many of the offers appearing on this sit. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. Gross income refers to income before taxes. As the old adage goes, taxes are a fact of life. The average cost of a gallon of gas in 1950 was 18 cents, while the cost of a new car wa the average annual salary in the united states in 1950 was $3,210.